What Are Property Taxes In South Dakota . Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Web the property tax system in south dakota consists of two parts: Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Local governments, such as municipalities and school. Ad valorem refers to a tax imposed on. Web overview of south dakota taxes. South dakota has a fairly straightforward property tax system. This surpasses both the national average of 0.99%. Web table of contents. Across south dakota, the average effective property tax rate is 1.08%. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Assessment a taxing district is the entity with and taxation.

from itep.org

Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Web overview of south dakota taxes. Assessment a taxing district is the entity with and taxation. South dakota has a fairly straightforward property tax system. Web the property tax system in south dakota consists of two parts: Ad valorem refers to a tax imposed on. This surpasses both the national average of 0.99%. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00.

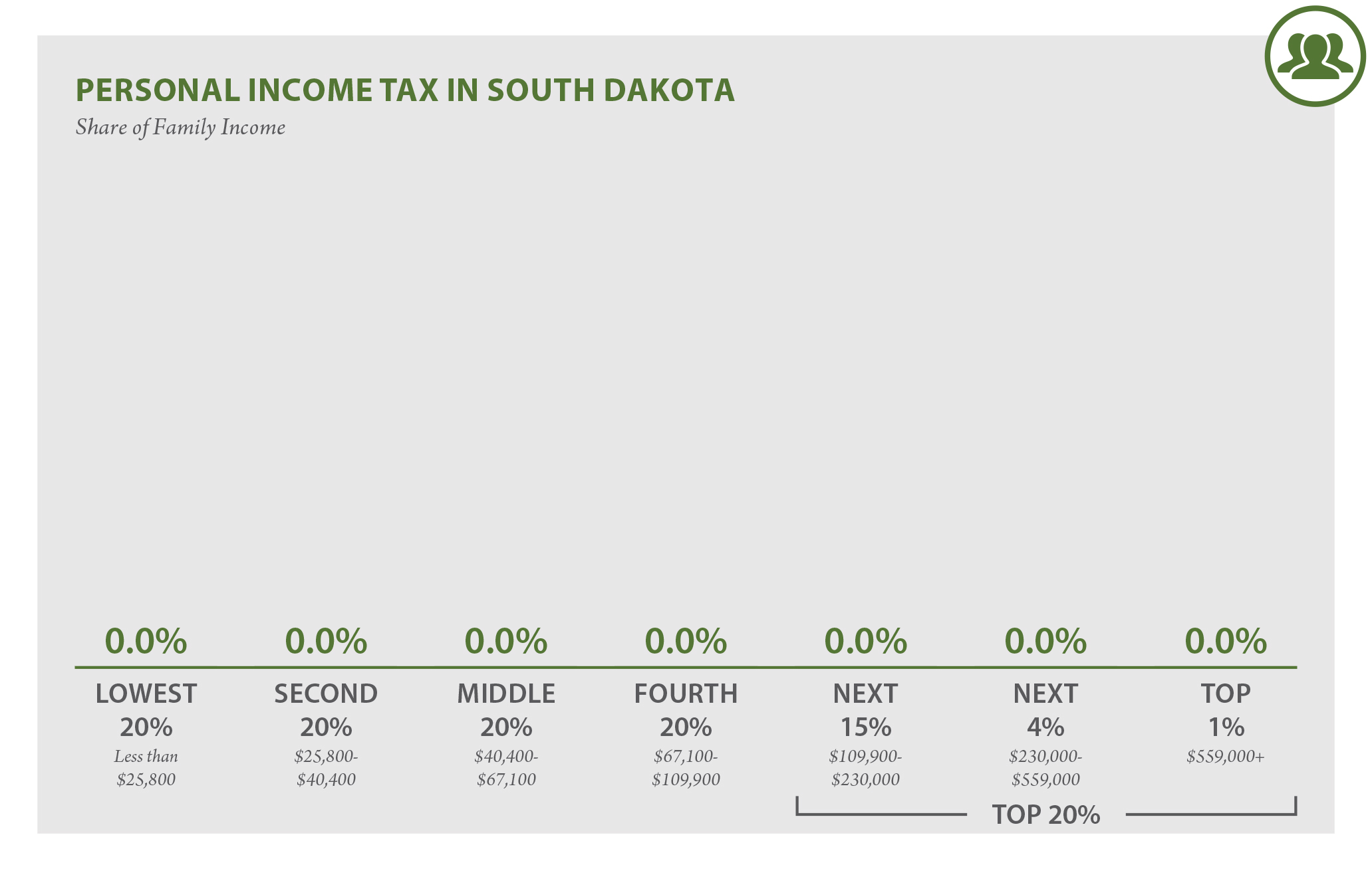

South Dakota Who Pays? 6th Edition ITEP

What Are Property Taxes In South Dakota Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Web overview of south dakota taxes. Ad valorem refers to a tax imposed on. Web the property tax system in south dakota consists of two parts: Assessment a taxing district is the entity with and taxation. Local governments, such as municipalities and school. Web table of contents. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. South dakota has a fairly straightforward property tax system. Across south dakota, the average effective property tax rate is 1.08%. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. This surpasses both the national average of 0.99%.

From www.formsbank.com

Schedule C Other Property Transfers South Dakota Inheritance Tax What Are Property Taxes In South Dakota Web table of contents. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Web overview of south dakota taxes. Web the property tax system in south dakota consists of two parts: Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value. What Are Property Taxes In South Dakota.

From www.accountingtoday.com

20 states with the highest realestate property taxes Accounting Today What Are Property Taxes In South Dakota Ad valorem refers to a tax imposed on. This surpasses both the national average of 0.99%. Local governments, such as municipalities and school. Web the property tax system in south dakota consists of two parts: Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Web the property tax. What Are Property Taxes In South Dakota.

From southdakotasearchlight.com

‘Somebody has to pay, ultimately’ Legislative committee begins study What Are Property Taxes In South Dakota Across south dakota, the average effective property tax rate is 1.08%. South dakota has a fairly straightforward property tax system. This surpasses both the national average of 0.99%. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Web the median property tax in south dakota is $1,620.00. What Are Property Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 6th Edition ITEP What Are Property Taxes In South Dakota Across south dakota, the average effective property tax rate is 1.08%. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such as municipalities and school. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Web in. What Are Property Taxes In South Dakota.

From fideliaupchurch.blogspot.com

south dakota property tax abatement Fidelia Upchurch What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Web overview of south dakota taxes. South dakota has a fairly straightforward property tax system. Across south dakota, the average effective property tax rate is 1.08%. Assessment a taxing district is the entity with and taxation. Web the property. What Are Property Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 6th Edition ITEP What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Web the property tax system in south dakota consists of two parts: Web overview of south dakota taxes. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota. What Are Property Taxes In South Dakota.

From southdakotasearchlight.com

‘Somebody has to pay, ultimately’ Legislative committee begins study What Are Property Taxes In South Dakota Across south dakota, the average effective property tax rate is 1.08%. South dakota has a fairly straightforward property tax system. Local governments, such as municipalities and school. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Web the median property tax in south dakota is $1,620.00 per. What Are Property Taxes In South Dakota.

From southdakotatruth.com

Vote Yes On F For Higher Property Taxes South Dakota Department of What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Ad valorem refers to a tax imposed on. This surpasses both the national average of 0.99%. Local governments, such as municipalities and school. Assessment a taxing district is the entity with and taxation. Web table of contents. Web property. What Are Property Taxes In South Dakota.

From www.pinterest.com

Chart 4 South Dakota Local Tax Burden by County FY 2015.JPG South What Are Property Taxes In South Dakota Web overview of south dakota taxes. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Across south dakota, the average effective property tax rate is 1.08%. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. South dakota. What Are Property Taxes In South Dakota.

From www.kxnet.com

North Dakota Property Owners Will Receive Estimated Property Tax What Are Property Taxes In South Dakota Across south dakota, the average effective property tax rate is 1.08%. Local governments, such as municipalities and school. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota. What Are Property Taxes In South Dakota.

From www.pinterest.com

Chart 2 South Dakota Tax Burden by Type of Tax FY 1950 to 2015.JPG What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such as municipalities and school. Ad valorem refers to a tax imposed on. South dakota has a fairly straightforward property tax system. Assessment a taxing district is the entity with and taxation. Web table of contents. Web. What Are Property Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 7th Edition ITEP What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Across south dakota, the average effective property tax rate is 1.08%. Web overview of south dakota taxes. Web the property tax system in south dakota consists of two parts: Assessment a taxing district is the entity with and taxation.. What Are Property Taxes In South Dakota.

From www.steadily.com

South Dakota Property Taxes What Are Property Taxes In South Dakota This surpasses both the national average of 0.99%. South dakota has a fairly straightforward property tax system. Web overview of south dakota taxes. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Ad valorem refers to a tax imposed on. Web the property tax is an ad valorem tax on. What Are Property Taxes In South Dakota.

From dakotafreepress.com

South Dakota Offers 7thLowest State/Local Tax Burden, But Not for What Are Property Taxes In South Dakota South dakota has a fairly straightforward property tax system. Web overview of south dakota taxes. Local governments, such as municipalities and school. This surpasses both the national average of 0.99%. Web property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local. Across south dakota, the average effective property tax rate is 1.08%.. What Are Property Taxes In South Dakota.

From espnsiouxfalls.com

Shocking Low Property Taxes in South Dakota Are In This County What Are Property Taxes In South Dakota Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such as municipalities and school. Assessment a taxing district is the entity with and taxation. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state.. What Are Property Taxes In South Dakota.

From www.taxuni.com

South Dakota Sales Tax 2023 2024 What Are Property Taxes In South Dakota Assessment a taxing district is the entity with and taxation. Web table of contents. Web in south dakota, property taxes make up around 75% of local government tax revenue and about 25% of the overall state. Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Across south dakota,. What Are Property Taxes In South Dakota.

From zamp.com

Ultimate South Dakota Sales Tax Guide Zamp What Are Property Taxes In South Dakota Web overview of south dakota taxes. Assessment a taxing district is the entity with and taxation. Across south dakota, the average effective property tax rate is 1.08%. Local governments, such as municipalities and school. South dakota has a fairly straightforward property tax system. Web the median property tax in south dakota is $1,620.00 per year for a home worth the. What Are Property Taxes In South Dakota.

From www.retirementliving.com

South Dakota Tax Rates 2024 Retirement Living What Are Property Taxes In South Dakota Web the property tax system in south dakota consists of two parts: Web the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Ad valorem refers to a tax imposed on. Web the property tax is an ad valorem tax on all property that has been deemed taxable by the. What Are Property Taxes In South Dakota.